If you run a business in Cyprus and you're doing B2B transactions across other EU countries: You have to submit your VIES returns every month. The process to submit these is straight forward.

Step 1: Login into the TFA portal

If you have your Tax For All account, just login into the Tax For All portal.

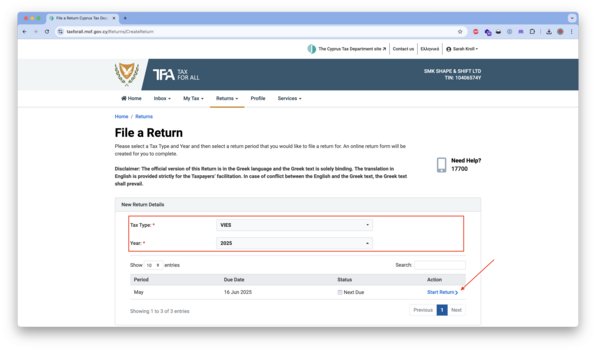

Step 2: File a VIES return

- Click on Returns -> File a Return within the main menu

- Select VIES as Tax Type and select the year you want to submit your VIES return for.

- Now the TFA is showing your the VIES returns you need to submit

- Click on Start Return to start your VIES return

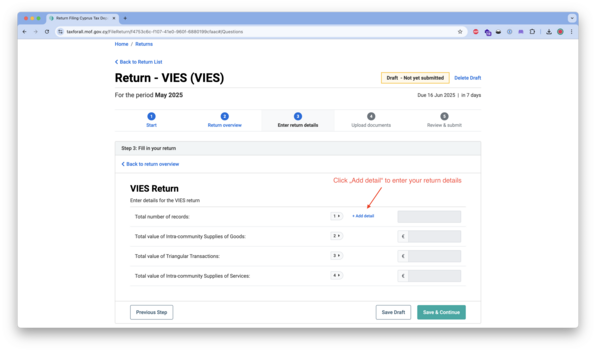

Step 3: Start the VIES return

- Click Save & Continue

- Click again Save & Continue or Enter VIES return

- Click Add Detail next to the Total number of records to add your return details

Step 4: Enter return details

You need to enter the details for each of your customers.

- Select the country of your customer

- Enter the VAT ID of your customer. It needs to include the company prefix.

- Enter the amount for the transactions. We have a list below that explains the differences.

- Click save

- Repeat this process for every customer

Step 5: Review & Submit

- Click Save & Continue

- If needed upload documents - Most of the time it's not necessary

- Click Save & Continue to get to the last step Review & Submit

- Click Submit Return to finally submit your VIES return

Example

You're creating a B2B invoice of 5.000,00 EUR to a company based in Germany selling your consulting services.

This is considered as a intra-community supplies of services, since you're selling a consulting service, it's a service, not physical goods.

Transaction Types

Intra-community Supplies of Goods

Goods that are sold and physically transported from Cyprus to VAT-registered businesses in other EU countries.

When to report:

If your business sells goods to another EU country and the customer has a valid EU VAT number.

Triangular Transactions

A three-party transaction across three EU countries where your Cyprus-based business is the intermediary. You invoice the customer, but goods go directly from supplier to final customer.

When to report:

If you act as the intermediary and benefit from the EU VAT simplification for triangular transactions.

Intra-community Supplies of Services

Services provided from Cyprus to VAT-registered businesses in other EU countries. These fall under the reverse charge mechanism.

When to report:

If your Cyprus-based business provides cross-border B2B services and the customer self-accounts for VAT in their own country.